The majority of people THINK they are rational, but in reality, take most actions based on EMOTION.

You, yes you reading this, do as well. As does Linn.

It is our job to become acutely aware of this and to take action to reduce the negative effects of that emotionality.

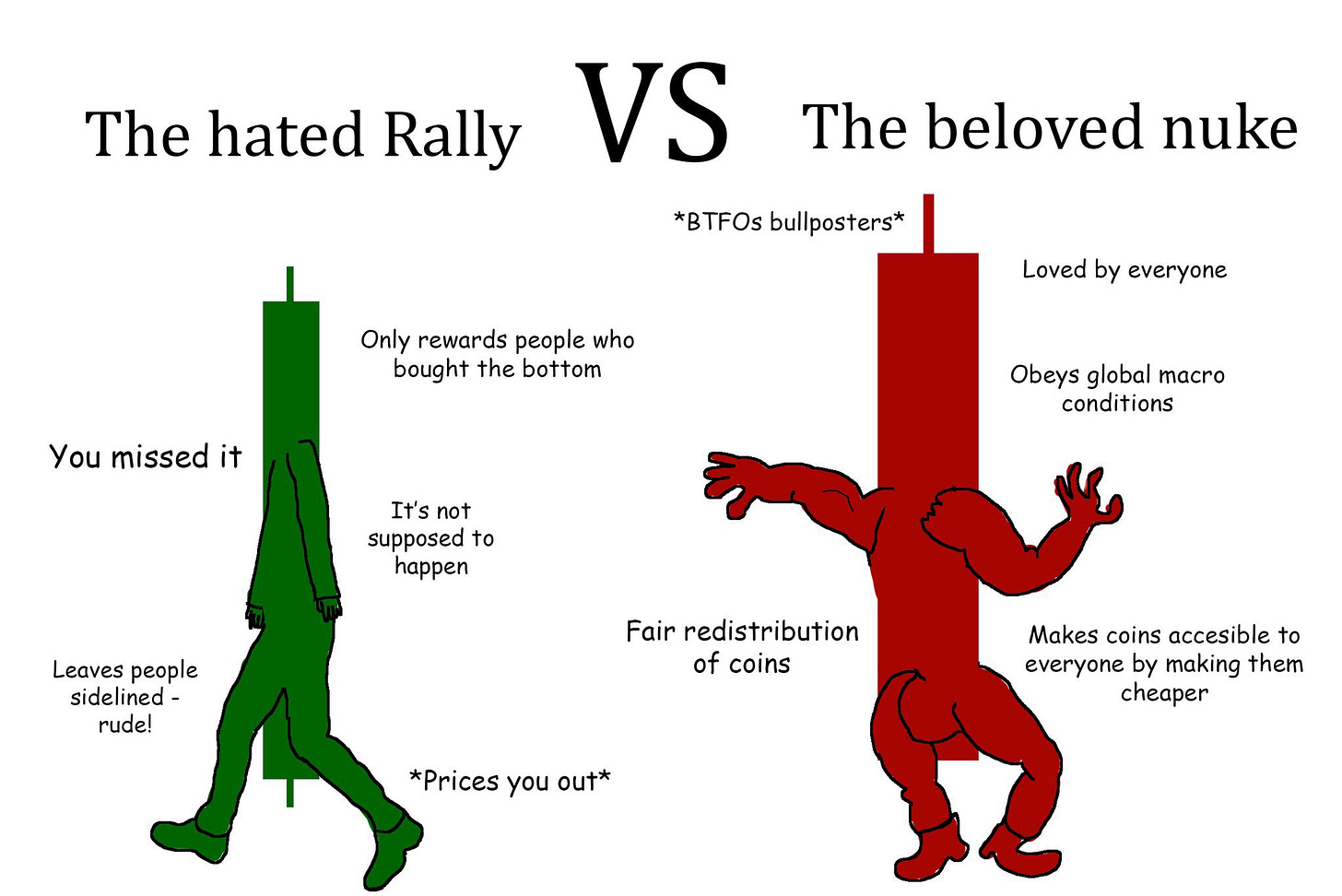

Success in investing seems like a technical endeavor, however, what seems technical (like technical analysis) is simply a framework representing the psychology of market participants.

One big problem many investors have is that it is easy to see the faults in others, but hard to see them in ourselves.

This means you need to often reflect, and pose the unpleasant question: “What if I am wrong?”

In the previous issue of Linn’s Ledger I featured a tweet by CL talking about the Endowment Effect, owning something changes how we feel and react towards it, and how we react towards others when they criticize (or praise) that specific thing we own.

So imagine how it will feel, when you personally have invested thousands of dollars in a particular project, and you have seen this project go up in price (positive reinforcement), and you see many people talking positively about it (because their bags are up too)…will it feel good to take a moment to re-evaluate if it is still a good project? If your original thesis still stands?

No, it will FEEL bad.

And I don’t know about you, but I am not in investing to FEEL, I am in investing to make money.

So suck it up, and review every one of your investments critically, form a counterpoint wherever possible to what you think will happen, review what could cause issues down the line, what market demands a project may not fulfill.

For example, let’s take this tweet by sto:

Are most people overexposed to ETH? I personally think that….hang on, let me put in a paywall on this Substack to encourage people who haven’t signed up yet to check out the 7-day Free trial which is free:

Keep reading with a 7-day free trial

Subscribe to Linn's Leverage to keep reading this post and get 7 days of free access to the full post archives.